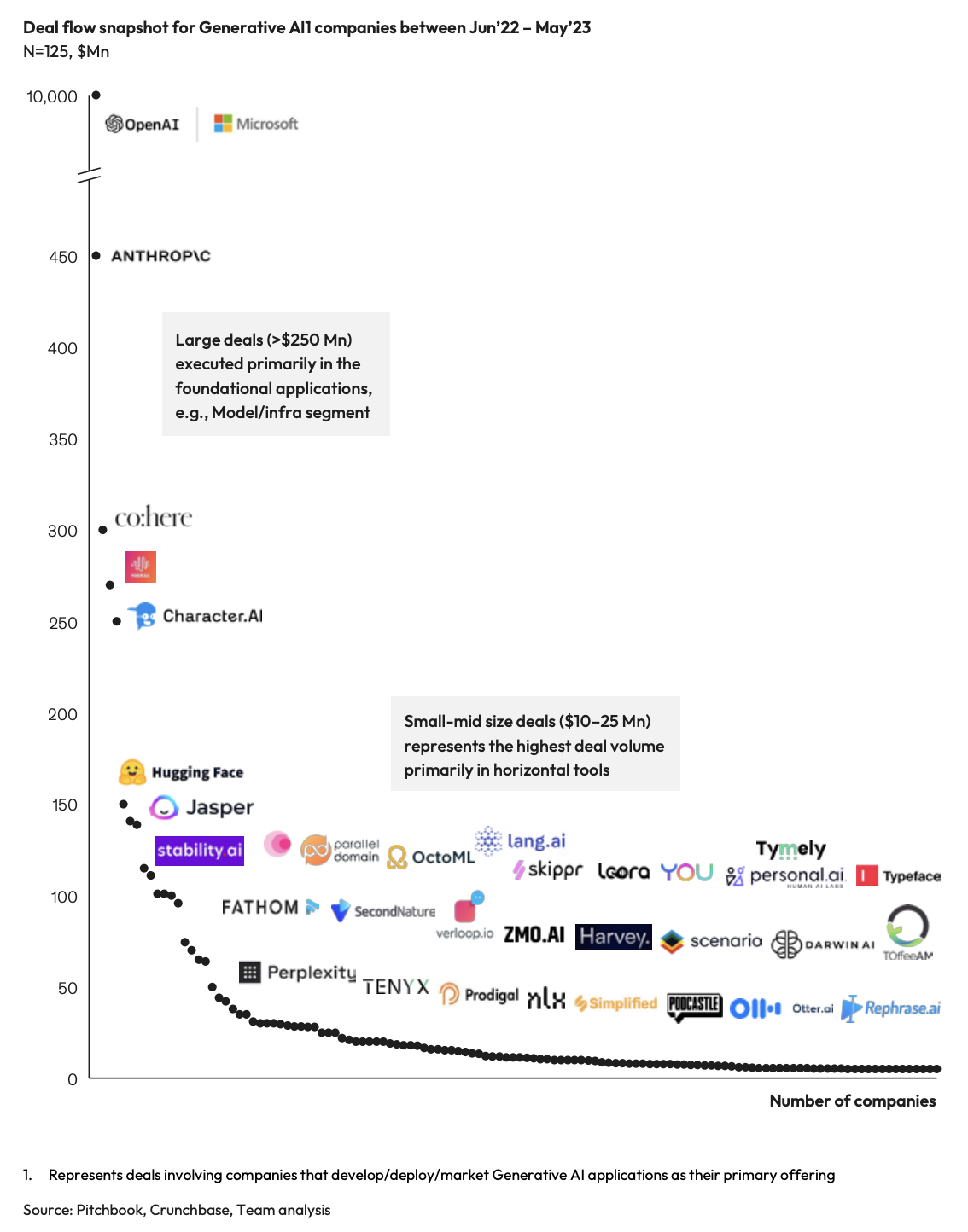

After the spurt in cloud-driven SaaS from 2015, the software industry is undergoing another seismic shift with the capabilities of Generative AI (GenAI), fueled by billions of dollars invested in creating Large Language Models (LLMs). While companies like OpenAI building the infrastructure layer made AI the buzz this year, vast opportunities for innovators of all sizes lie in the application layer on top.

“AI is the new electricity. Electricity revolutionized all industries and changed our way of life, and AI is doing the same… The advance of AI creates opportunities for everyone in all corners of the economy to explore whether or how it applies to their area,” writes Andrew Ng, founder of DeepLearning.AI, in MIT Technology Review.

What does it mean for SaaS? We’re seeing a shift to SaaS.ai with the emergence of a long tail of AI-first SaaS companies, says a study by SaaSBoomi with knowledge partner McKinsey.

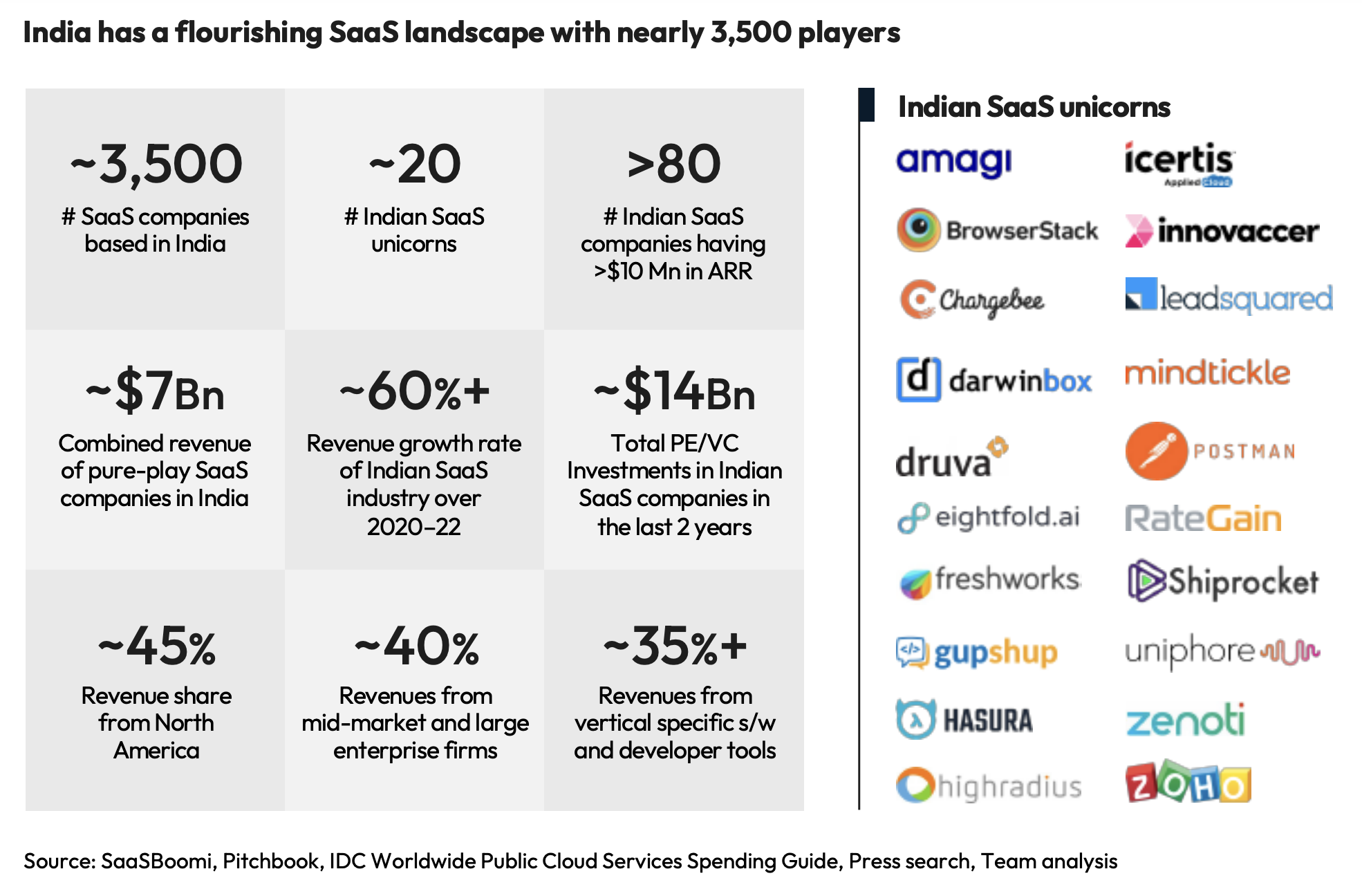

India has a thriving SaaS industry with over $7 billion in annual revenues. GenAI creates possibilities to spin that flywheel faster as founders pivot to SaaS.ai. Over 60 GenAI hotspots have caught the attention of Indian SaaS companies, says the SaaSBoomi study.

As the technology is new, its application to many domains is yet to be explored. That creates new opportunities for agile innovators.

“SaaS companies from India are hungry for AI technologies. Their founders absorb and use AI tech at a place similar to that in the Bay Area. We are excited about how fast AI is moving into SaaS startups and gaining momentum,” says Shekhar Kirani, Partner, Accel.

For example, Blend makes AI-native design editing software for ecommerce sellers to create professional product photos quickly without relying on agencies. The founders began playing around with Stable Diffusion (GenAI foundational model for image editing) after its release last year. Then they added more GenAI tools, scalability, and speed to rise to #1 on Product Hunt six months back.

“We embrace a full-stack AI research approach, from R&D to crafting user experiences,” says Vishwanath Kollapudi, founder & CEO of Blend. “This approach gives us visibility and control over every aspect that requires adaptation, whether it’s at the model level, infrastructure, or product development.”

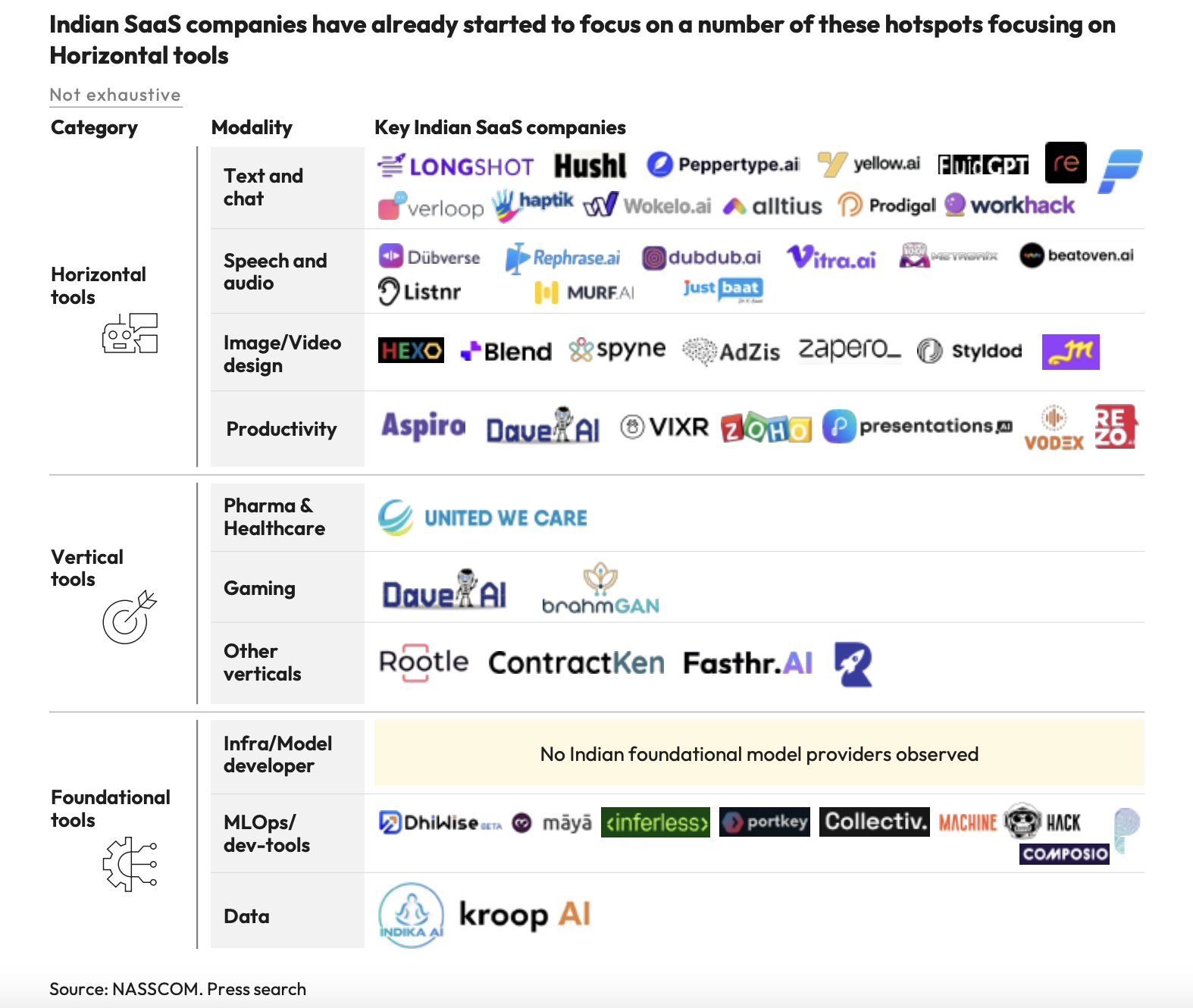

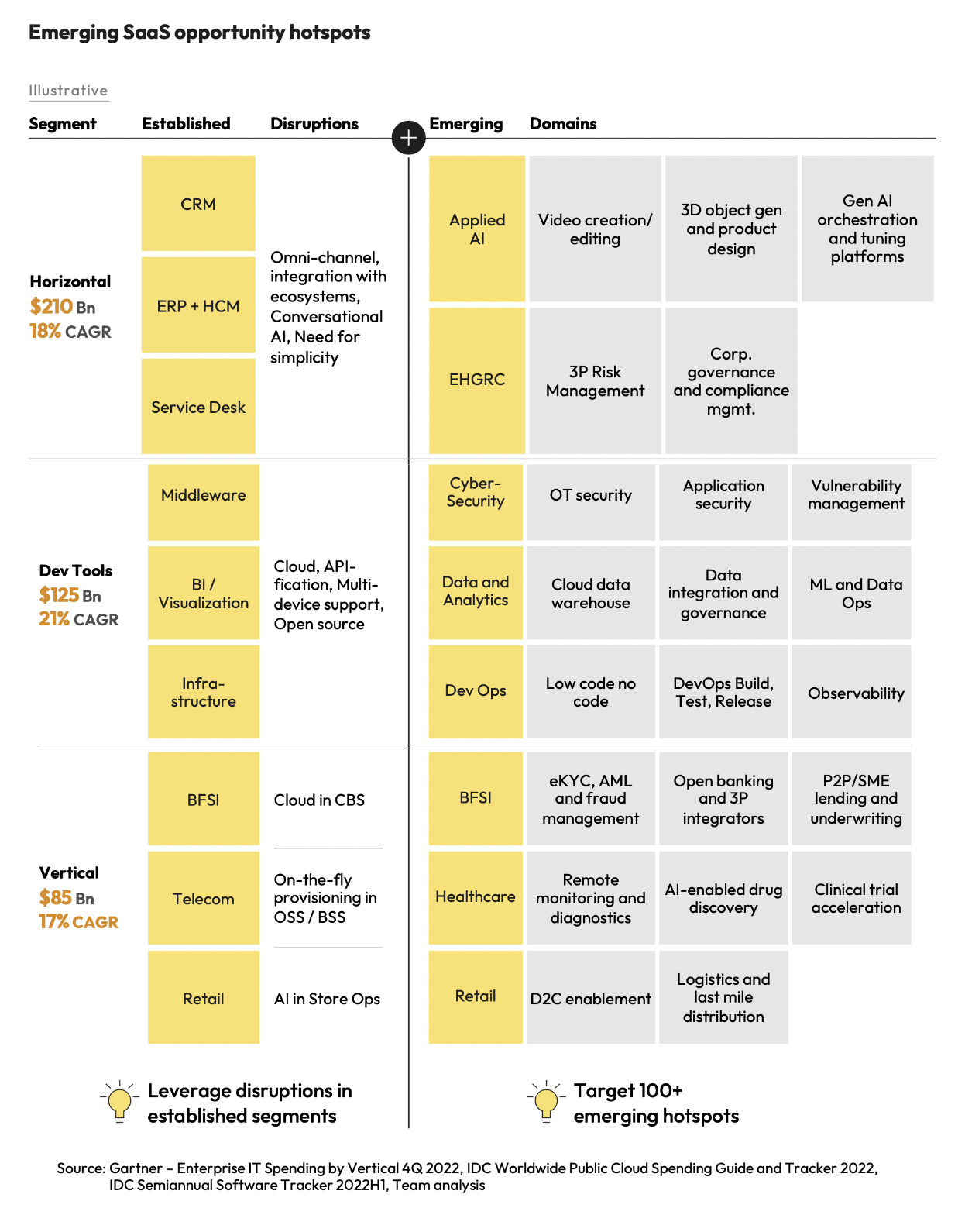

Every SaaS founder worth her salt is busy hacking a path to the GenAI bandwagon. Most of the early movers are in horizontal SaaS categories for text, speech, video, and productivity tools. But there are also vertical SaaS players emerging with GenAI-powered tools in healthcare, gaming, and other verticals.

Not surprisingly, a number of companies are focusing on GenAI power for dev tools and MLOps (machine-learning operations), an area of strength for SaaS from India. Data is another hot spot of activity.

The SaaSBoomi study expects vernacular Large Language Models (LLMs) to emerge in the region to target a large population. Although the cost of building foundational models appears prohibitive, India’s frugal innovation will come into play.

“India will have to innovate at lower cost than in the US, as it did with UPI (Unified Payments Interface) and many other things,” says Manav Garg, founder and CEO, Eka Software Solutions.

The massive adoption of UPI transactions over the past five years has created a huge amount of fintech data. Collaboration with the government and banks could lead to India-specific foundational models for use cases like lending, points out Garg.

“AI models keep developing for various languages in the world, but there has been a significant lag in the state-of-the-art models reaching Indian languages. To service India-specific needs across ecommerce, fintech, edtech, and more, building India-specific models is going to be critical,” says Hemant Mohapatra, Partner at Lightspeed India.

“AI deployments in India have to be conscious of the unit costs. We need small, use-case-focused models that are optimized on hardware. The use-case focus requires us to work with companies in India to specialize the models for their needs. A majority of LLMs today focus on text, but Indian use cases need a deep understanding of voice as well as text,” adds Mohapatra. “These challenges are as much technical as cultural and will require an India-based team committing their lives to build this for the long term, with a strong focus on R&D in the beginning, but balancing it with a customer-backward approach to solve problems that both local and global enterprises will adopt to service their audiences in India.”

Naganand Doraswamy, founder and managing partner, Ideaspring Capital, feels the layer above the foundational model is where India’s engineering talent can make a difference. “I’m talking about the middle layer, such as tools that will extract the relevant data to train the model or induce the right prompts. The application layer on top is chaotic right now and the foundational layer is very expensive to build. So the middle layer is where we’re looking at companies now.”

And, as they say, you ain’t seen nothing yet. AI thought leader Mustafa Suleyman, founder of DeepMind (acquired by Alphabet) and Inflection AI, says GenAI is just an intermediate phase. What’s coming is bigger.

“Five years from now, models will be over 1000 times larger than what you see today in GPT-4. Instead of just generating new data, the models will be able to generate sequences of actions. We’re going to see AI that doesn’t just say things but AI that can do things,” says Suleyman in an interview with the Economist. “It will be able to talk to humans and other AIs and use APIs to decide, for example, the right sequence in a supply chain. You can imagine that being applied to many different parts of our economy. The world is your oyster.”

Every Rose has Thorns

The shift in the technological landscape presents both an opportunity and a threat to SaaS companies. So even as founders are eager to seize new opportunities, they’re keeping an eye out for AI’s disruption of their products, markets, and business models. Investors too are galvanized by the urgency to spot disruptors of business models looming on the horizon.

“SaaS companies will have to change and align with the new business models. There is no other option,” says Kirani. “If teams can’t include AI aggressively and take advantage of cost savings and business models, they will be left behind.”

As CMS (content management solutions), chatbots, code and design tools, and workflow automation evolve with the integration of GenAI, SaaS founders need to understand the extent to which their business will be disrupted.

“Step one is to see whether your core workflow is getting disrupted. Once you understand that and if you have to now pivot, do you have the data and skillset to get to the new way of working? And if you have that, you will have to see if you have the capital to do that,” explains Garg. “Typically, companies below $5 million in ARR (annual recurring revenue) are constrained by their skillset, data, and capital. So they are the most vulnerable to GenAI disruption.”

The SaaSBoomi report has a GenAI disruption index to help SaaS founders evaluate their response based on their scale and the level of disruption they face. They need to assess shifts in their competitive landscape and reimagine defensible moats.

Competitive shifts can take different forms. GenAI could enable radical cost cuts in providing a service or product. It could reduce the costs of customers switching to a different product. Or it could change how services and products are accessed with a conversational AI front-end, such as with ChatGPT plugins.

These assessments will influence founders in deciding their GenAI adoption strategy. Their scale and business metrics will also come into consideration.

For example, those who adopt a complete business model pivot for aggressive growth in ARR (annual recurring revenue) should be prepared for declines in profit and free cash flow because of higher development time and costs. Others may choose to get started by using GenAI to enhance internal productivity for a modest rise in ARR, while abiding by the Rule of 40 (a SaaS benchmark where revenue growth rate and profitability margin are both 40% or above).

The business and funding environment will be key determinants in these choices. What it boils down to is that a founder has to take a number of factors into account in formulating a GenAI strategy that finds a middle way between opportunity and threat.

But, as Andrew Ng urges innovators, the time to act is now. “Learning about AI creates disproportionately more opportunities to do something that no one else has ever done before… Moreover, many of the opportunities are within reach of broadly tech-savvy people, not just people already in AI.”