Starting from scratch, the tech exec-turned-VC shares a tactical guide on how to think about founding, product, and funding

There are more questions than answers in the run-up to and during the early stages of founding a company. Founders have many ideas they could pursue and several different approaches they take. The only way to streamline your startup journey is by talking to people who have had a ringside view of the process.

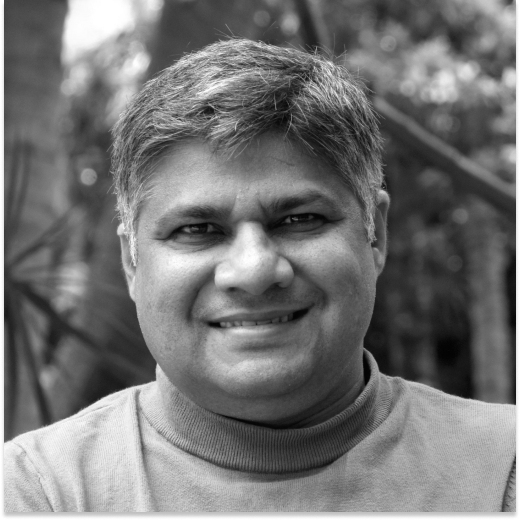

Shekhar Kirani, a partner at Accel, was among the first VCs to see Indian SaaS as a diamond in the rough. He has written some of the earliest checks for record-making SaaS firms including Freshworks, Chargebee, BrowserStack, and Zenoti. He is known for having the Midas touch. We know him as the Don Valentine of Indian SaaS. His wisdom draws from his time working in tech companies.

In a roundtable, he shared some insights around founding journey with fluent insight and characteristic wit.

1. Why do we start up? What is the end goal?

To solve a pain point. A problem that you have spotted and can relate to, which no one has solved for, or at least solved well for.

What you absolutely need to have, in Shekhar’s view, are a great idea, good unit economics, a good market, and the conviction to put in the time. How do you know if your idea is great? The VC says that has to do with product thinking: “It takes keen observation of what people struggle with and how.”

Your execution will be affected by unit economics and market conditions, he adds.

“If market conditions and unit economics are good, you can win even if you’re an okay entrepreneur. If you are a great entrepreneur but in a niche market with enough fish in the pond, no matter how efficient you are, you will exhaust the market.”

He reminds founders that starting up is a long-haul journey. Typically, it means putting in one decade of work, says Shekhar. “By the time you hit 35, all your prime years will have gone towards solving this problem. So pick a problem that is worth spending 10 years solving.”

2. How do you cultivate the entrepreneur mindset?

Once an entrepreneur decides to start up, it is hard to continue working for somebody else. Shekhar’s advice is: Don’t try to start up part-time and make it a success.

“Because almost all fail even while doing it full time, so part time is impossible,” he quips. “Do the work, collect the data, meet people and talk, and once you have enough data, commit to it long term.”

Entrepreneurs who belong to families with very high regard for ownership-driven ventures benefit from already having that mindset. “If you come from traditional business families, there is the advantage of understanding unit economics — how do I buy, how do I sell, will I make money? If it does not pass the family sniff test or the dhanda test, you know it is not a good idea.”

In other cases, people have to learn how to make decisions. That is non-negotiable, particularly in India, where somebody else makes major decisions for us.

“We are not trained to make decisions but are suddenly exposed to it as entrepreneurs. So you have to learn the art and science of that.”

Understand people. Without that, you can’t run a big team and earn big revenue. Extend that learnability to other subjects too.

Your learnability index has to be high, according to Shekhar, and that only happens from meeting up, having discussions, and — importantly — reading books. “All the entrepreneurs who are successful read a lot.”

Another skill Shekhar points to here is the ability to spot talent. There is no way for an entrepreneur to be successful without having a large and thoughtfully assembled team.

“You need to know who is the right person and how to recruit them. For me that is the sign of a good founder — knowing how to spot raw diamonds and rewarding them with salaries and ESOPs over time.”

3. How to prepare yourself for a life as an entrepreneur?

Clarity of thinking and focus will help with every action that is involved in entrepreneurship.

Give yourself two to three years of runway to clear your mind and have a really good stab at the problem. Any less than that, and it is difficult to judge potential. Have that milestone and build the capacity to run your life for three years.

“There will be a lot of pressure,” warns Shekhar. “Colleagues will buy cars, go on international holidays. But you need to have the internal stamina to say it is okay.” If you don’t prepare yourself as such, you risk giving up too soon.

One hack is to keep your own lifestyle very simple and low maintenance.

4. How do you know whether enough people are affected by your particular pain point?

Identify whether what you have is a push idea or a pull idea.

There are multiple ways to know if people are looking for your solution, says Shekhar. Imagine that you are building a children’s product. He suggests going to 20 houses in any metropolitan city and asking them what are the top five things they would want to change for their kids. They may talk about issues with lunch, homework, and illnesses.

“If you do 100 studies and no one mentions your problem, then I call it a ‘push idea’,” Shekhar observes. “The push market is hard, you have to spend money to acquire customers. If there is no need for it, you have to evangelise it.”

Another measure is whether many people are buying particular keywords on Google AdSense and if search volumes are going through the roof. If there is a lot of interest around your keywords already, the pain point you want to solve is in a pull market. Pull-market ideas are easier to work with. You can simply buy an ad and sell it.

One of the risks to be wary of while talking to people about pain points is selective hearing. As a founder, you may be tempted to pay attention to things that are favorable to you rather than things that are not. Don’t fall into that trap.

5. Is it possible to win with a push market idea?

Shekhar shares the example of Zenoti, a company he has backed for a long time. It makes cloud software for spas and salons. When the founders started out, they did not think that would be a very big market, they did not know if the idea was great but it was good enough. To evangelize, they started by doing demos.

“Every demo is converted into a customer. That means people did not know it but there was a latent need.” The company got creative. It sent CEOs gift boxes — an iPad with a 4-min video specifically personalised for their business. The ROI on that was worthwhile for Zenoti, which hit a $1 billion valuation by 2020.

With time, a push market can become a pull market. “Just show clarity of thought in what you are doing,” Shekhar advises.

6. How to take no for an answer?

This is a tough one. You were probably finishing at the top of your class, always performing better than your friends, and accustomed to getting praised for your work. You have a specific picture of yourself and that can make any rejection feel more brutal. But that is all a part and parcel of starting up. “You will hear a lot of ‘nos’ before you hear any ‘yesses’,” says Shekhar.

How you take that ‘no’ makes all the difference. Make sure all the basic factors are in place — unit economics, market conditions, the idea, and your 10-year commitment. Argue the ‘no’ with data.

7. What makes a good co-founder?

Most founders tend to go with their roommate, batchmate, hostel mate, colleague — someone they know. But making a decision based on familiarity alone can backfire.

Shekhar has a foolproof gauge. “Have you seen elements of scale in this person? Do they figure out things on their own? If there is a problem given, are they resourceful? Do they go out of their way to find answers?”

Transparency and resourcefulness are the co-founder qualities you cannot overlook. A co-founder should be able to speak their mind on what is and isn’t working.

As a founder, you also need to learn the art of storytelling. “When you don’t practice your elevator pitch, potential co-founders won’t reflect on it for two minutes. You have to repeat the message of what you’re doing and why, otherwise, people will move to other options.” If you can’t articulate that story, you can’t convince the cofounder.

Looking for a co-founder outside your circle requires influencing. You have to meet and exchange ideas, which can sometimes take six months or more. Shekhar brings up one of the companies he works with, where the founder roped in a co-founder she did not personally know. Her process was to meet with 6–7 people, zeroing in on one of them, and working together for six months before saying they are aligned. The founder was clear on exactly what she was looking for. She was focused on the business side, while the co-founder would work on the building.

8. What sort of equity should you offer a co-founder?

This is a question of make-or-break significance. The way you structure ownership guides many considerations including how VCs view you. By default, people go with a 50–50 split. By the time they realize their mistake, it is too late. It is important to see who your co-founder is and what value they are bringing. “If I see that a company is diluted too much, I don’t invest. The company is dead on arrival if it is split between five co-founders,” Shekhar notes.

He stresses preserving ownership. In one instance, a company had given away 30–40 percent to a foreign investor despite having a great team, business model, and initial efforts. It took the team 12 months to negotiate with those investors and take back the equity.

Here’s how to look at splitting equity. “If you start out together even before having the idea, then you guys are equal partners. If not, then you do not need to break ownership equally.”

9. How to think about approaching investors?

Convincing an investor has everything to do with your own conviction. Typically you want conviction in your mind first, which you should be able to clearly articulate. “Your ability to convince me based on your data helps me convince those in my network,” Shekhar shares.

A lot of founders wonder what the benchmarks are for the first seed round. How much to give? Shekhar’s suggestion is to be careful about the level of dilution in the early rounds. Around 15–20% is usually acceptable in the seed round, he says, since it is all about risk-reward then.

Besides, the company has to fit into the categories the specific VC is interested in — say SaaS, B2B, or B2C marketplaces, etc. VCs can also be convinced if someone they trust tells them about the company.

“If you have all these things — unit economics, right market conditions, good ideas, and a dedicated team — VCs will approach you before you approach them,” the investor concludes.