“SaaS has strong recurring revenue. SaaS has strong margins. Then why does SaaS need external money to grow?”

My dad asked me this when I was doing my first fundraise. While I know the answer I still have not been able to convince him (baap hai mera!).

Fundraising is a part of any fast-growth SaaS journey. The money raised can be invested in R&D for new products, new market expansion, sales team expansion, or any M&A. The fundamental premise being, if there is capital that we know where to deploy to grow faster, we should be able to raise the money and invest in the growth.

Keeping aside all the coolness attached to the fundraising announcements, the process itself is not so glamorous — it is inherently with a huge market asymmetry and a low probability of success.

My attempt in this post is to share some learnings from our journey which might help demystify some part of this process.

While the most significant reason to get to fundraising is the capital that the company needs, there is value in getting the right investor for the specific stage. As Jason Lemkin says, “There is only so much space on the cap table. Be sure of the names on it”.

The basic hygiene to check for is if the investor gets the business. And there is a huge upside if we also get lucky on multiple other elements like signalling, customer intros, advice, hiring, and Next Round.

The Process

While there are some specific nuances in each part of the fundraising process, the way to think about it as a founder is just like a sales process with different stages and probabilities. The only difference, in this case, is that you need to be successful and convert only once for the entire process to be a success. 🙂

There are basically 4 big parts to this (each of this can be a separate blog post but here is a quick primer on each of them).

1. Why are we raising and are we ready to raise?

We should raise because it helps us be visible in the press. NOT. At different stages, the reason to raise money will be different. But the simple (and basic) rule is to raise when you need the capital. Any capital (Equity/Debt) infused in the company expects a return and it is important to understand what that expectation is, so that we have the visibility to deliver on those expectations.

Readiness needs just a few things:

- Content — The story that you want to tell that will make investors want to invest in this business. Make sure you understand your audience (investors in this case — who are looking at a return) and make a sales pitch for them. There could be an impact-focussed investor who could be looking at how the problem you are solving is having an impact on the larger population or a hedge fund-like investor which is trying to find a seat on the next hyper-growth rocketship (and just wants to understand why this is a 100x story).

- Data — While I would over-invest in getting the story right, the data is supercritical to have a strong signal on your understanding of the business. Data includes all the relevant internal (all metrics) and external (market, competition, etc.) data that are relevant at the particular stage.

- Plan — Investors are always investing in the future. While the data and story build trust, the plan gives a sense of the potential. It’s important to iron out a plan (in terms of growth, spend planning, hiring, etc.) that will give a sense of how the company will look like in 1 to 3 years.

2. Who should we go to for raising our investment and how do we approach them?

Depending on the stage of the company there are 4 main kinds of investors:

- Strategic investors — Investors investing out of a balance sheet and a part of a larger business which could be aligned with your business

- Purely financial investors — These are generally growth-stage investors who would look at a purely financial investment (just like a public market investment) with very little involvement in the day-to-day activities

- General Venture Capital — These are the more prominent and visible VCs (specialising in different stages) that invest LP money into companies with a specific time horizon in mind. Most of them have a plan/structure in place to help the companies (as individuals or a fund) on a periodic basis and are present on the board

- Angel Investors — More relevant in early stages but they are individuals investing their personal money in expectation of a certain return

Approaching investors could be in multiple forms ranging from cold emails to warm connections with investor networks or other founder friends. Like in a typical sales process, it would always help to enter with a certain level of credibility/trust that you’ve built through your business or your connections.

There is another option of going with an investment banker who helps with raising money and is an expert at it. It also helps the founders to focus on the business while a lot of the leg work around planning and setup is done by the investment banker. While this is a common practice at late Series C+ stages, using a banker earlier is construed (not objectively) as a weakness/inability to raise on our own.

Additional note: It is important to understand how a fund works and the different roles of people within the fund (just like in a sales process), to understand who is a supporter/gatekeeper/influencer/sponsor etc.

3. What do investors look for?

Investors are strongly opinionated — while that seems contrary to the whole idea of investing in startups which are at the edge of the future technologies, every quality investor has a strong personal algorithm/formula/mnemonic on how to evaluate companies which come from the tonne of mistakes that they’ve made (remember we are talking about startups where the probability of success is less than 1%).

Here are a few things that I have seen investors talk about/look for/screen for:

- Team and Energy — How good is the founding and management team? Basically looking for Product — Market — Founder — Fit and a strong belief that the founders have the strongest correlation to the outcome.

- Data — What does the data say? Has the team displayed the ability ‘objectively’ to drive certain outcomes at the previous stage which they can do at scale in the future? Is the market large enough today or will it be large enough at a future period of time? Is the competitive intensity high and how has the company done against the competition in the past?

- Thematic — Which is the company out there that fits into our view on how the market is changing and is going to capitalise on that? Is there a structural advantage in this company that we have seen work in other companies in a similar/adjacent space?

4. How do I know what is the right valuation for my company?

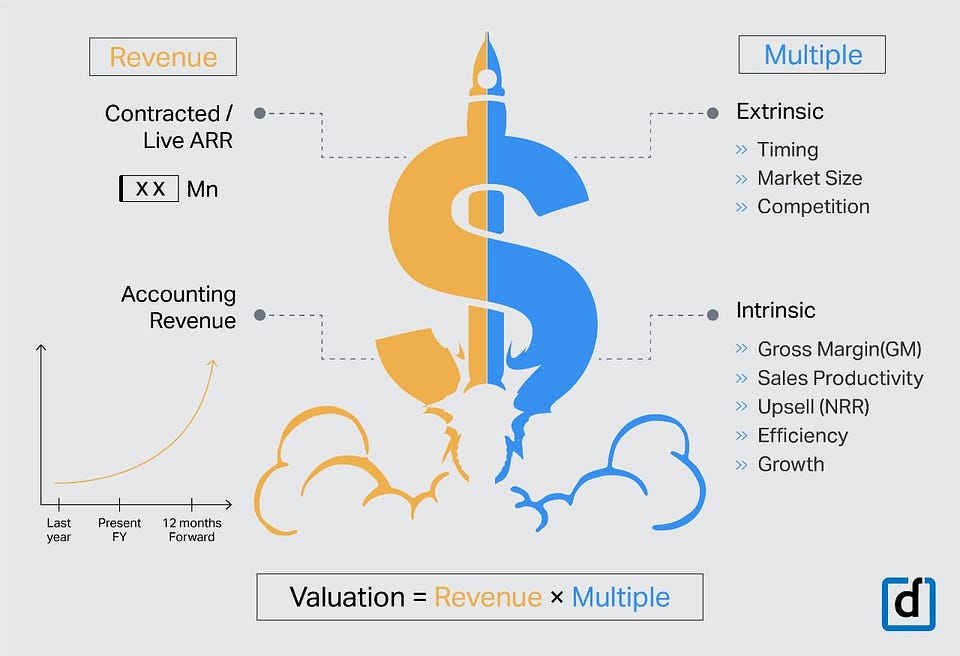

Valuation (unlike popular knowledge) is driven by a lot more factors than what the public markets are doing at that point of time with SaaS companies. For the founder, it comes down to the money she wants to raise and the amount of dilution she is okay with.

While there is no real method to the madness, there are clear factors that influence it. Below is the map of the most common factors that influence valuation.

- Revenue: CARR, ARR, Revenue, Forward Revenue

Multiple:

- Intrinsic — GM, Sales Productivity, Growth Rate, Sales Efficiency (Revenue to Burn profile), Churn, Product Stickiness, Ability to Upsell. The usual LTV/CAC is an indicator for all the above

- Extrinsic — The Opportunity — Timing, Market Size (TAM Calculation), Competitive Intensity in the space.

The whole process doesn’t end with a term sheet. There are a lot of details that happen post this in a term sheet, SHA, SSA etc. which is a topic for another post. Here’s hoping 1000s of SaaS companies get funded in India and give excellent returns to investors.